Why is Bitcoin price Crashing? Analyzing the Recent 16% Drop in Bitcoin price

Key Points:

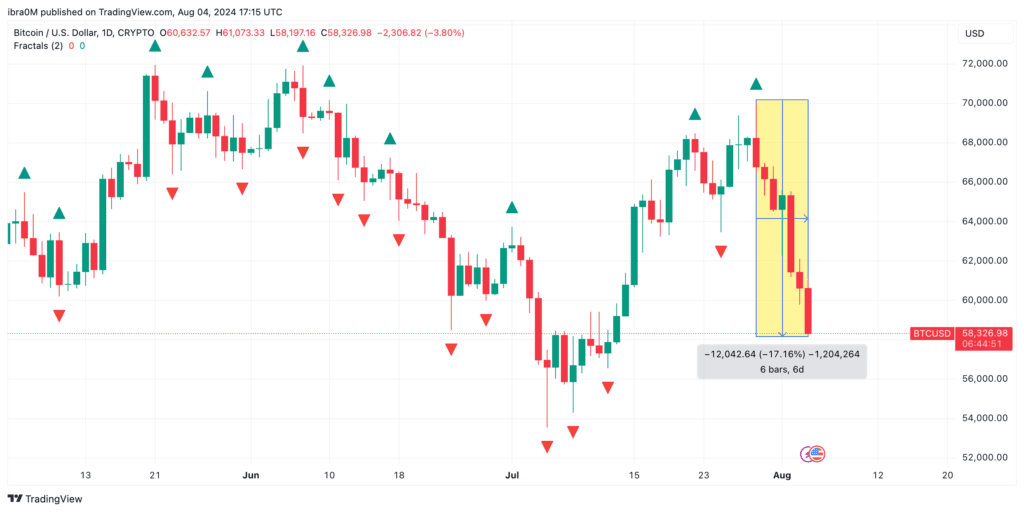

- Bitcoin price tumbled as low as $58,898 on Aug 4, marking a 16.17% decline within the 7-day timeframe.

- Bitcoin deposits on exchanges increased by 5,000 BTC within the first 3 days of August.

- Technical indicators suggest bull traders must now hold the $55,000 support to avoid cascading liquidations.

Bitcoin Price Analysis

Bitcoin price tumbled as low as $58,898 on Aug 4, marking a 16.17% decline within the 7-day timeframe. On-chain data trends suggest BTC could face more volatility in the week ahead.

Bitcoin Price Down 16% in 7-Days

Following Donald Trump‘s appearance at the Bitcoin Nashville conference on Jul 27, Bitcoin price made a positive start to the week. On Monday, May 29, Bitcoin price crossed the $70,000 mark for the first time in over 40 days dating back to June 7, 2024. However, due to a streak of bearish catalysts from the US government, the Bitcoin price rejected at $70,000 and entered a steep downtrend as the week unfolded.

Looking at the chart above, we see how BTC price has posted a series of lower lows in each of the last 3 days. At the time of writing on Aug 4, Bitcoin is exchanging hands at $58,326 per coin, reflecting a 17.16% fall from the weekly timeframe peak of $70,050 recorded on Monday.

Slower-Than-Expected NFP Data Could Rescue BTC

Bitcoin’s price downtrend accelerated on Wednesday, July 31, as the US Federal Reserve opted against a rate cut as many investors had anticipated.

But looking ahead, the dovish decline in US Non-Farm Jobs data posted on Friday, Aug 1, could trigger a positive swing in market momentum when the market resumes trading on Aug 5.

On Aug 4, 2024, the US Bureau of Labor Statistics published data on US unemployment claims for July 2024.

According to the report, US Non-farm Payrolls rose by 114,000 in July, falling short of the market expectation of 175,000 and coming in below June’s increase of 179,000.

This slower-than-expected growth may lead the Federal Reserve to reassess their monetary policy decisions, potentially considering rate cuts later in the next Fed meeting slated for September.

Historically, a dovish Fed lowering interest rates often increases investor appetite for riskier assets. Hence, as the prospects of a Fed cut grow in the coming week, risk-assets, ranging from stocks to cryptocurrencies, will likely attract increased market demand.

This dovish expectation could encourage US-based investors, especially institutional players investing in actively trading BTC ETFs, to begin making strategic Bitcoin purchases to front-run the next Fed rate cut.

If this scenario plays out, Bitcoin bulls can expect to avoid a breakdown below the psychological support at the $55,000 level in the week ahead.

BTC Price Forecast: Neutral Bias Favours $62,000 Rebound

Bitcoin’s recent price action suggests a neutral bias, leaning towards a rebound to $62,000, as the Relative Strength Index (RSI) has bounced off the oversold region (30) and is currently at 43.

The Bollinger Bands indicate a contraction in volatility, suggesting a potential breakout. The upper band ($61,300) and lower band ($56,800) will be key levels to monitor. A move above the upper band could confirm the rebound, while a break below the lower band would indicate further weakness.

While the technical indicators suggest a neutral bias towards a $62,000 rebound, Bitcoin’s price action will ultimately depend on market sentiment and external factors. A cautious approach is recommended, with key resistance and support levels at $56,800 and $61,300 to guide trading decisions for the week ahead. The popular AI chatbot warned that BTC could slump to the mid-$40,000 range.

Bitcoin’s Nosedive: When Will It End?

It was less than a week ago, on Monday, when the primary cryptocurrency skyrocketed to $70,000 for the first time since early June. This rally came on the heels of Donald Trump’s pro-bitcoin speech during the 2024 BTC conference in Nashville.

However, the asset couldn’t keep the momentum going and dropped by four grand on the same day. The landscape worsened by the end of the week, and the asset dumped to $62,200 on Friday after the US released its July jobs report, which outlined growing unemployment rates to a 3-year high.

Wall Street crashed as well, but BTC kept losing value during the weekend as it never stops trading. This culminated earlier today with a price dip to under $60,000, which became a new 3-week low.

What Drives the Price South?

Perplexity named a few reasons why BTC went down in the past week and keeps dropping. First, it focused on the outflows from the Bitcoin-related investment financial vehicles, such as the US-based ETFs. As reported yesterday, Friday was a particularly negative day with more than $230 million leaving the largest ETFs.

Additionally, the AI chatbot mentioned the “lack of bullish momentum” since BTC dropped below critical support levels, such as $62,000, but so far has managed to remain above the psychological $60,000 line despite the brief dip from earlier. However, a decisive break of that level could exacerbate the downfall further.

“Market analysts have noted a general nervousness among investors, particularly in light of upcoming economic indicators that could influence Federal Reserve policies.” – concluded Perplexity.

Conclusion

The recent dramatic fluctuations in the Bitcoin price reflect broader global economic uncertainties and investor anxieties. The market’s direction will depend on key economic indicators and Federal Reserve policy decisions in the coming weeks.